All Categories

Featured

Table of Contents

Simply select any form of level-premium, long-term life insurance coverage policy from Bankers Life, and we'll convert your policy without requiring proof of insurability. Policies are convertible to age 70 or for 5 years, whichever comes later - universal life insurance vs term life insurance. Bankers Life supplies a conversion credit history(term conversion allocation )to insurance policy holders approximately age 60 and via the 61st month that the ReliaTerm policy has actually been in pressure

They'll supply you with straightforward, clear options and aid customize a plan that fulfills your specific requirements. You can rely on your insurance policy agent/producer to aid make complicated economic decisions concerning your future easier (decreasing term life insurance policy). With a background going back to 1879, there are some things that never alter. At Bankers Life, that suggests taking a personalized method to aid safeguard the individuals and households we serve. Our objective is to offer outstanding solution to every insurance holder and make your life simpler when it pertains to your claims.

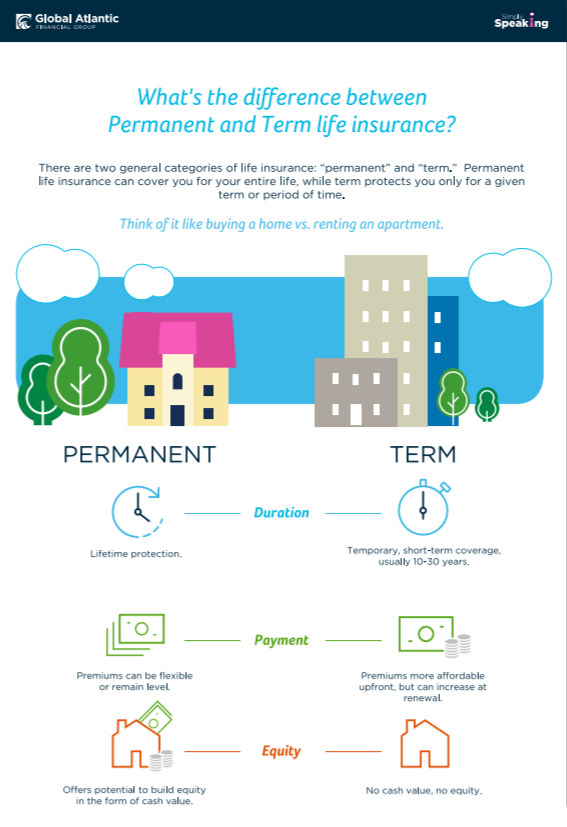

In 2022, Bankers Life paid life insurance policy asserts to over 658,000 insurance holders, completing$266 million. Bankers Life is accredited by the Better Business Bureau with an A+ ranking since March 2023, along with obtaining an A( Excellent)ranking by A.M. Generally, there are two kinds of life insurance coverage plans-either term or long-term plans or some mix of both. Life insurance firms use numerous forms of term plans and traditional life policies as well as "interest delicate"products which have come to be much more prevalent given that the 1980's. Term insurance policy offers security for a specific duration of time. This period could be as brief as one year or provide protection for a particular variety of years such as 5, 10, 20 years or to a specified age such as 80 or in many cases up to the earliest age in the life insurance policy death tables. Presently term insurance coverage prices are extremely competitive and amongst the most affordable historically seasoned. It must be kept in mind that it is a commonly held belief that term insurance is the least expensive pure life insurance policy coverage available. One requires to review the plan terms thoroughly to choose which term life options appropriate to satisfy your specific scenarios. With each new term the premium is raised. The right to restore the plan without evidence of insurability is an important benefit to you (level term life insurance advantages and disadvantages). Otherwise, the danger you take is that your health may wear away and you may be incapable to acquire a policy at the same prices or perhaps in all, leaving you and your recipients without coverage. You need to exercise this choice during the conversion period. The size of the conversion period will differ depending on the sort of term policy purchased. If you transform within the prescribed duration, you are not needed to give any type of details concerning your health and wellness. The premium rate you

pay on conversion is normally based on your"present obtained age ", which is your age on the conversion day. Under a degree term policy the face quantity of the plan remains the same for the entire duration. With reducing term the face quantity minimizes over the duration. The costs remains the very same every year. Often such policies are sold as home mortgage protection with the amount of.

insurance lowering as the balance of the home loan reduces. Traditionally, insurance providers have actually not deserved to transform costs after the plan is marketed. Given that such policies might continue for years, insurance companies must make use of traditional death, interest and expenditure price quotes in the costs calculation. Adjustable premium insurance policy, nonetheless, allows insurance providers to use insurance coverage at lower" existing "premiums based upon much less conventional presumptions with the right to change these costs in the future. Under some plans, premiums are required to be spent for a set variety of years. Under other policies, premiums are paid throughout the insurance policy holder's life time. The insurance company spends the excess costs bucks This sort of plan, which is in some cases called cash worth life insurance coverage, produces a savings component. Cash values are critical to a permanent life insurance coverage plan. In some cases, there is no connection in between the size of the cash money worth and the costs paid. It is the cash worth of the plan that can be accessed while the insurance holder lives. The Commissioners 1980 Standard Ordinary Mortality Table(CSO )is the current table utilized in determining minimum nonforfeiture values and plan reserves for common lifeinsurance policies. Lots of permanent plans will certainly have provisions, which define these tax demands. There are two basic classifications of irreversible insurance, traditional and interest-sensitive, each with a number of variants. Furthermore, each classification is typically offered in either fixed-dollar or variable kind. Conventional whole life policies are based upon long-lasting quotes ofcost, passion and death. If these quotes transform in later years, the company will change the costs appropriately but never above the optimum assured premium mentioned in the plan. An economatic entire life plan attends to a basic quantity of taking part entire life insurance with an additional supplemental insurance coverage supplied through using dividends. Since the premiums are paid over a much shorter span of time, the premium repayments will certainly be more than under the entire life plan. Solitary costs whole life is minimal settlement life where one large exceptional repayment is made. The plan is totally paid up and no further premiums are called for. Considering that a substantial payment is included, it needs to be watched as an investment-oriented product. Interest in single premium life insurance policy is primarily as a result of the tax-deferred treatment of the build-up of its cash money worths. Taxes will be incurred on the gain, nonetheless, when you give up the policy. You might obtain on the cash value of the plan, yet keep in mind that you might sustain a substantial tax costs when you give up, also if you have actually obtained out all the money value. The advantage is that enhancements in rates of interest will certainly be reflected faster in rate of interest sensitive insurance coverage than in conventional; the drawback, of course, is that decreases in passion prices will certainly likewise be really felt quicker in passion sensitive entire life. There are 4 fundamental interest delicate entire life policies: The global life policy is in fact greater than interest sensitive as it is designed to reflect the insurance firm's current mortality and expense along with interest revenues instead of historic prices. The company credits your costs to the money value account. Occasionally the business deducts from the money worth account its costs and the cost of insurance coverage defense, usually described as the death deduction cost. The balance of the cash money worth account gathers at the interest credited. The company assures a minimal rate of interest and a maximum mortality charge. These warranties are typically very traditional. Current assumptions are vital to passion delicate items such as Universal Life. When rates of interest are high, advantage projections(such as cash value)are also high. When rate of interest are reduced, these forecasts are not as appealing. Universal life is also the most adaptable of all the various type of plans. The plan typically gives you an option to select 1 or 2 kinds of fatality benefits. Under one option your beneficiaries received only the face quantity of the plan, under the other they get both the face quantity and the money value account. If you desire the optimum amount of death advantage now, the second alternative must be selected. It is vital that these presumptions be practical because if they are not, you may have to pay more to keep the plan from reducing or lapsing. On the other hand, if your experience is much better after that the assumptions, than you might be able in the future to skip a costs, to pay less, or to have the plan compensated at an early date. On the other hand, if you pay more, and your presumptions are sensible, it is feasible to compensate the plan at an early day (best term life insurance malaysia). If you surrender a global life plan you may get less than the cash money worth account due to abandonment charges which can be of 2 types.

You might be asked to make extra premium payments where coverage might end because the rate of interest rate dropped. The assured rate provided for in the plan is much lower (e.g., 4%).

Guaranteed Level Premium Term Life Insurance

In either situation you have to receive a certificate of insurance explaining the arrangements of the team plan and any kind of insurance policy charge. Usually the maximum amount of coverage is $220,000 for a mortgage and $55,000 for all other financial obligations. Debt life insurance policy need not be bought from the company giving the funding

If life insurance policy is called for by a creditor as a problem for making a funding, you may be able to assign an existing life insurance policy, if you have one. You might desire to buy group credit rating life insurance coverage in spite of its higher expense due to the fact that of its convenience and its availability, usually without detailed proof of insurability. what is a 30 year term life insurance policy.

Nevertheless, home collections are not made and premiums are sent by mail by you to the agent or to the company. There are particular aspects that often tend to enhance the expenses of debit insurance coverage even more than normal life insurance policy strategies: Specific expenditures coincide regardless of what the dimension of the plan, so that smaller sized policies issued as debit insurance policy will have greater premiums per $1,000 of insurance policy than larger dimension regular insurance coverage

Given that early gaps are pricey to a firm, the costs should be passed on to all debit insurance holders. Since debit insurance coverage is made to consist of home collections, higher commissions and charges are paid on debit insurance policy than on routine insurance. In a lot of cases these higher expenses are handed down to the insurance holder.

Where a business has different costs for debit and routine insurance policy it might be possible for you to acquire a larger quantity of normal insurance policy than debit at no additional expense - term life insurance with chronic illness rider. If you are believing of debit insurance, you ought to absolutely explore normal life insurance policy as a cost-saving option.

Which Of The Following Best Describes The Term Life Insurance

This plan is developed for those who can not originally pay for the normal entire life premium but that desire the higher premium protection and feel they will ultimately be able to pay the higher premium (ad&d insurance vs term life insurance). The family members plan is a mix plan that provides insurance policy defense under one agreement to all members of your instant family partner, spouse and kids

Joint Life and Survivor Insurance provides insurance coverage for 2 or even more individuals with the fatality benefit payable at the death of the last of the insureds. Costs are dramatically lower under joint life and survivor insurance than for policies that insure only one individual, because the likelihood of having to pay a fatality case is reduced.

Premiums are substantially more than for policies that guarantee a single person, considering that the chance of needing to pay a death claim is higher (houston term life insurance). Endowment insurance policy provides for the payment of the face total up to your recipient if death takes place within a details period of time such as twenty years, or, if at the end of the specific period you are still active, for the repayment of the face amount to you

Latest Posts

10 Year Level Term Life Insurance

Which Of The Following Is Not True About Term Life Insurance?

Term Life Insurance For Married Couples