All Categories

Featured

Table of Contents

Simply like any type of various other irreversible life plan, you'll pay a routine costs for a final expenditure plan for an agreed-upon fatality advantage at the end of your life. Each service provider has various guidelines and options, but it's fairly easy to handle as your recipients will certainly have a clear understanding of how to spend the money.

You might not need this type of life insurance policy. If you have irreversible life insurance policy in area your final costs may already be covered. And, if you have a term life policy, you might have the ability to transform it to an irreversible policy without some of the extra steps of getting final expense coverage.

Developed to cover restricted insurance demands, this kind of insurance can be a budget-friendly alternative for people that just intend to cover funeral expenses. Some policies might have constraints, so it is necessary to review the small print to ensure the policy fits your need. Yes, obviously. If you're searching for a long-term alternative, global life (UL) insurance remains in place for your entire life, as long as you pay your premiums.

What Is The Difference Between Life Insurance And Funeral Insurance

This alternative to final expenditure protection supplies alternatives for extra family members insurance coverage when you require it and a smaller sized protection quantity when you're older.

Last expenditures are the expenditures your household pays for your interment or cremation, and for other things you might desire at that time, like an event to commemorate your life. Assuming concerning final costs can be hard, recognizing what they cost and making certain you have a life insurance policy large enough to cover them can assist spare your household an expense they may not have the ability to pay for.

Funeral Cover With No Waiting Period

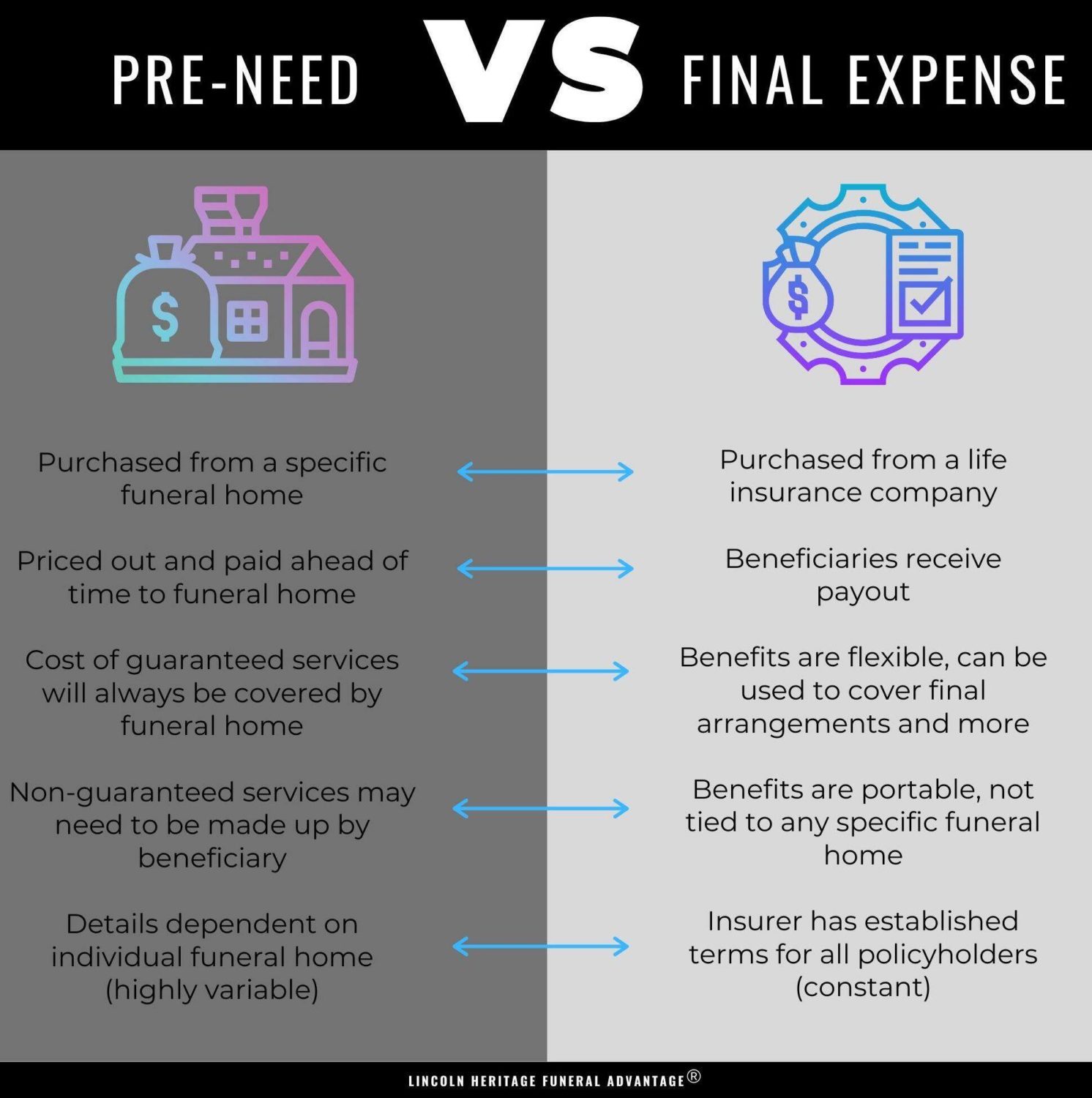

One alternative is Funeral service Preplanning Insurance coverage which permits you choose funeral products and solutions, and fund them with the purchase of an insurance coverage plan. Another alternative is Last Cost Insurance.

It is projected that in 2023, 34.5 percent of family members will pick burial and a higher portion of households, 60.5 percent, will select cremation1. It's approximated that by 2045 81.4 percent of families will certainly choose cremation2. One reason cremation is becoming more preferred is that can be less expensive than interment.

Aaa Final Expense Insurance

Depending upon what your or your family members desire, things like funeral plots, serious markers or headstones, and caskets can enhance the price. There might likewise be expenses in addition to the ones particularly for burial or cremation. They could consist of: Covering the cost of travel for family and liked ones so they can go to a solution Provided dishes and various other expenditures for a celebration of your life after the service Purchase of unique attire for the solution When you have a great idea what your last costs will certainly be, you can aid plan for them with the best insurance plan.

Medicare only covers clinically essential expenses that are required for the diagnosis and therapy of an illness or condition. Funeral prices are not considered clinically necessary and consequently aren't covered by Medicare. Final expenditure insurance policy offers a simple and relatively low-priced way to cover these expenses, with policy advantages ranging from $5,000 to $20,000 or even more.

Individuals normally buy last expenditure insurance with the intent that the recipient will utilize it to spend for funeral costs, arrearages, probate charges, or other relevant expenditures. Funeral expenses could include the following: People often question if this kind of insurance policy coverage is required if they have financial savings or other life insurance.

Life insurance policy can take weeks or months to payout, while funeral expenditures can begin accumulating immediately. Although the beneficiary has the last word over exactly how the cash is utilized, these plans do make clear the insurance policy holder's objective that the funds be utilized for the funeral and relevant expenses. Individuals frequently purchase irreversible and term life insurance policy to aid provide funds for ongoing costs after a person dies.

Over 50 Funeral Insurance

The most effective means to make certain the policy amount paid is spent where planned is to call a beneficiary (and, in some cases, an additional and tertiary beneficiary) or to position your dreams in an enduring will certainly and testament. It is frequently a good technique to alert key recipients of their anticipated responsibilities when a Final Expense Insurance coverage is obtained.

It was created to satisfy the needs of senior adults ages 50 to 80. Costs begin at $22 monthly * for a $5,000 protection policy (costs will certainly differ based upon issue age, sex, and protection quantity). Additionally, prices and costs are guaranteed not to increase. No medical exam and no health inquiries are called for, and consumers are ensured coverage through automatic qualification.

For additional information on Living Advantages, go here. Coverage under Guaranteed Problem Whole Life insurance coverage can commonly be completed within two days of preliminary application. Begin an application and buy a plan on our Surefire Problem Whole Life insurance policy DIY web page, or call 800-586-3022 to talk with a licensed life insurance policy agent today. Below you will certainly discover some regularly asked inquiries should you pick to make an application for Last Expense Life Insurance by yourself. Corebridge Direct certified life insurance policy representatives are waiting to respond to any kind of added inquiries you might have pertaining to the protection of your enjoyed ones in the occasion of your passing away.

The child rider is purchased with the concept that your kid's funeral expenses will certainly be totally covered. Kid insurance motorcyclists have a fatality benefit that varies from $5,000 to $25,000.

The Best Burial Insurance

Note that this plan just covers your youngsters not your grandchildren. Last cost insurance policy advantages don't end when you join a policy.

Riders come in different types and offer their own advantages and motivations for joining. Cyclists deserve considering if these supplemental options relate to you. Motorcyclists include: Faster death benefitChild riderLong-term careTerm conversionWaiver of costs The increased survivor benefit is for those that are terminally ill. If you are seriously ill and, relying on your details policy, established to live no longer than six months to two years.

The disadvantage is that it's going to decrease the fatality advantage for your recipients. The youngster cyclist is purchased with the notion that your youngster's funeral expenditures will be fully covered.

Protection can last up until the child transforms 25. The lasting treatment rider is similar in principle to the increased fatality advantage.

Final Expense Insurance Near Me

As an example, somebody who has Alzheimer's and calls for daily support from health assistants. This is a living advantage. It can be obtained versus, which is very helpful due to the fact that lasting treatment is a considerable expenditure to cover. A year of having someone take care of you in your home will certainly cost you $52,624.

The motivation behind this is that you can make the switch without being subject to a medical examination. And considering that you will no more be on the term plan, this additionally indicates that you no more need to fret about outliving your plan and losing on your fatality advantage.

Those with existing wellness problems might run into greater costs or constraints on coverage. Keep in mind, policies typically cover out around $40,000.

Think about the month-to-month costs repayments, however additionally the comfort and economic safety and security it offers your family. For lots of, the peace of mind that their liked ones will not be strained with economic challenge during a difficult time makes last expense insurance coverage a worthwhile financial investment. There are two sorts of last expenditure insurance:: This kind is best for individuals in fairly health that are seeking a means to cover end-of-life expenses.

Insurance coverage amounts for simplified issue policies generally go up to $40,000.: This kind is best for people whose age or wellness prevents them from purchasing other types of life insurance coverage. There are no health and wellness needs at all with ensured concern plans, so anyone that satisfies the age demands can normally certify.

Below are some of the aspects you must take into consideration: Examine the application process for various plans. Some might need you to answer health concerns, while others use assured problem options. See to it the service provider that you pick supplies the quantity of insurance coverage that you're looking for. Check into the settlement choices available from each service provider such as month-to-month, quarterly, or yearly premiums.

Latest Posts

10 Year Level Term Life Insurance

Which Of The Following Is Not True About Term Life Insurance?

Term Life Insurance For Married Couples